Wealth

MORTGAGES

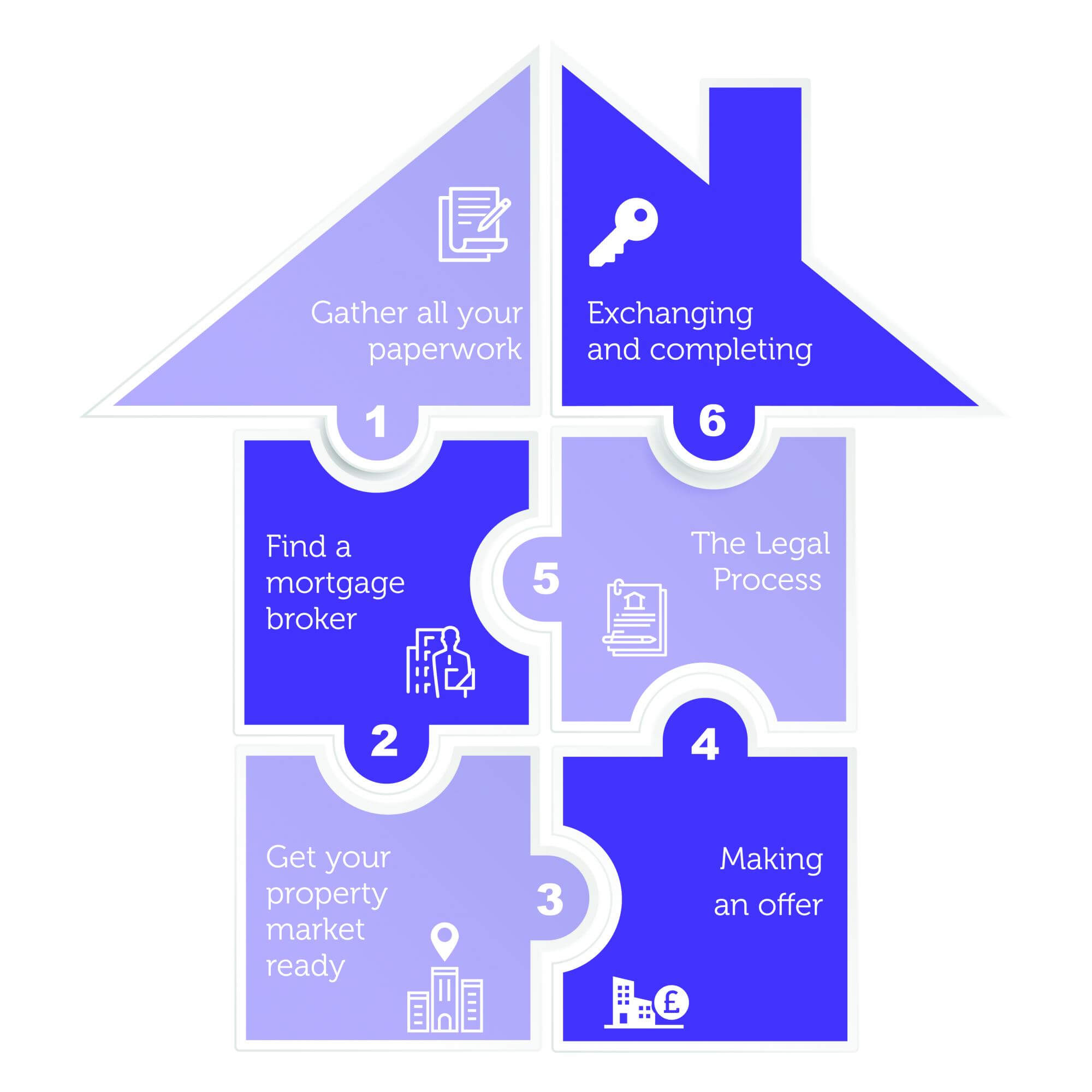

We compare a market of over 90 mortgage providers and their products, before laying out the best options for your individual circumstances. We also have specialist experience in providing mortgage services to support self-employed buyers, company directors, partnerships, and buy-to-let buyers. And as a fully independent advisor, you can trust Condies to help secure the ideal mortgage for you, without bias.

Whether commercial or private, we understand that a mortgage is a major commitment, which is why our mortgage advice considers both your current circumstances and your future ambitions. For new clients, we can even make your new property more affordable with tax advice that puts money back in your pocket, while our existing clients enjoy the easiest application possible, with key financial information already on file. As a fully independent advisor you can trust, Condies Wealth assesses the entire market.

MORTGAGE services testimonials

AD – Remortgaging

“I was enormously grateful for having had Randal McLister at Condies Wealth advise us and take us through the process.”

KJ – Remortgaging

“We have been and will continue to recommend you to anyone who will listen to us!”

MB – Home purchase

“I was delighted with the guidance I received by both Terri and Randal throughout my home purchase it made it much easier.”

AE – Mortgage

“Thank you so much for an incredible service, and we look forward to using you again when it comes to our remortgage!”

To speak to one of our specialist team, please email mortgages@condieswealth.co.uk or call us on 01383 721421.

Condies Wealth Strategies Limited, trading as Condies Wealth, is authorised and regulated by the Financial Conduct Authority (FCA) no.748895.

Registered in Scotland SC381967. Registered office 10 Abbey Park Place, Dunfermline, KY12 7NZ.

You should remember that the value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you have invested.

The guidance contained within the website is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK. Trusts, some forms of estate planning/inheritance tax solutions are not regulated by the Financial Conduct Authority. All statements concerning the tax treatment of products and their benefits are based upon our understanding of current tax law and HMRC practices both of which are subject to change in the future. Levels and bases of reliefs from taxation are also subject to change and are dependent on your individual circumstances'.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients.

FOS details can be found at https://www.financial-ombudsman.org.uk/